The standard corporate income tax rate in Malaysia is 24. Key Malaysian Income Tax Info Do I need to file my income taxYes you would need to file your income tax for this past year if.

Why It Matters In Paying Taxes Doing Business World Bank Group

Non-resident company branch 24.

. Paid-up capital up to RM25 million or less. 17 on the first RM 600000. Income tax rates.

On the First 5000 Next 15000. Useful reference information on Malaysian Income Tax 2017 for year of assessment 2016 for resident individuals. A SME is defined as a company resident in Malaysia which has a paid-up capital of ordinary shares of RM25.

Tax Rate of Company. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. A Look at the Markets.

Technical or management service fees are only liable to tax if the services are rendered in Malaysia. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Corporate Tax Rates 2017.

On the chargeable income exceeding RM600000. On first RM500000 chargeable income 17. 5001 - 20000.

Taxable Income RM 2016 Tax Rate 0 - 5000. Rate TaxRM A. Malaysia Corporate Tax Rate 2017 Table.

24 above MYR 600000. Classes of income Income tax is chargeable on the following classes of income. Headquarters of Inland Revenue Board Of Malaysia.

Income Tax Rate Malaysia 2018 vs 2017. Corporate Tax Rates in Malaysia. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015.

The CbC Rules require that Malaysian multinational corporation MNC groups with total consolidated group revenues of MYR 3 billion to prepare and submit CbC reports to the tax authorities no later than 12 months after the close of each financial year. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million. 20001 - 35000.

Malaysia personal income tax rates what is the income tax rate in malaysia individual income tax in malaysia for budget 2017 new personal tax rates for. Resident company with a paid-up capital of RM 25 million or less and gross income from business of not more than RM 50 million. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates.

35001 - 50000. The current CIT rates are provided in the following table. In general capital gains are not taxable.

Year Assessment 2017 - 2018. Resident company with paid-up capital above RM25 million at the beginning of the basis period 24. Malaysia Corporate Tax Rate 2017 Table.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information. Rate On the first RM600000 chargeable income. Corporate tax rate for resident small and medium-sized enterprises with capitalization under MYR 25 million 17 on the first MYR 600000.

Malaysia Corporate Tax Rate History. No guide to income tax will be complete without a list of tax reliefs. Non-resident company branch 24 YA 2017 to YA 2018 Resident company with paid up capital of RM25 million and below at the beginning of the basis period On first RM500000 chargeable income On subsequent chargeable income 18 20 to 24 Resident company with paid up capital above RM25 million at the.

Malaysia Corporate Tax Rate was 24 in 2022. A UK private company limited by guarantee DTTL its network of member firms and their. Social Security Rate For Companies.

Tax Rate of Company. Capital Gains Tax in Malaysia. Malaysian entities of foreign MNC groups will generally.

Corporate tax for companies originating in the Territory of Labuan and operating a trading activity in this territory. Country-by-country CbC reporting. Companies incorporated in Malaysia with paid-up capital of MYR 25 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on.

While the 28 tax rate for non-residents is a 3 increase from the previous years 25. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Malaysia 25 25 25 24 24 Malta 35 35 35 35 35 Mauritius 15 15 15 15 15 Mexico 30 30 30 30 30.

Irs Announces 2018 Tax Brackets Standard Deduction Amountore Paying Ta 2020 Overall Ranking And Data Tables Pwc Table A. The below reliefs are what you need to subtract from your income to determine your. Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower.

Companies which had been successful in increasing revenues will benefit from reduction in their income taxes for the year of assessment 2017 and 2018. Other corporate tax rates include the following. That does not control.

See also Are Dugout Box Seats At Busch Stadium All Inclusive. 3 of audited income. A Labuan entity can make an irrevocable election to be taxed under the ITA in respect of its Labuan business activity.

The carryback of losses is not permitted. Tax under the Labuan Business Activity Tax Act 1990 instead of the Income Tax Act 1967 ITA. Corporate companies are taxed at the rate of 24.

For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24. 24 in excess of RM 600000. Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie.

Dec 2014 Yearly. On subsequent chargeable income 24. However gains derived from the disposal of real property.

Masuzi June 29 2018 Uncategorized Leave a comment 22 Views. On the First 5000. A gains or profits from a business.

Following table will give you an idea about company tax computation in Malaysia. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018.

Malaysian Bonus Tax Calculations Mypf My

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

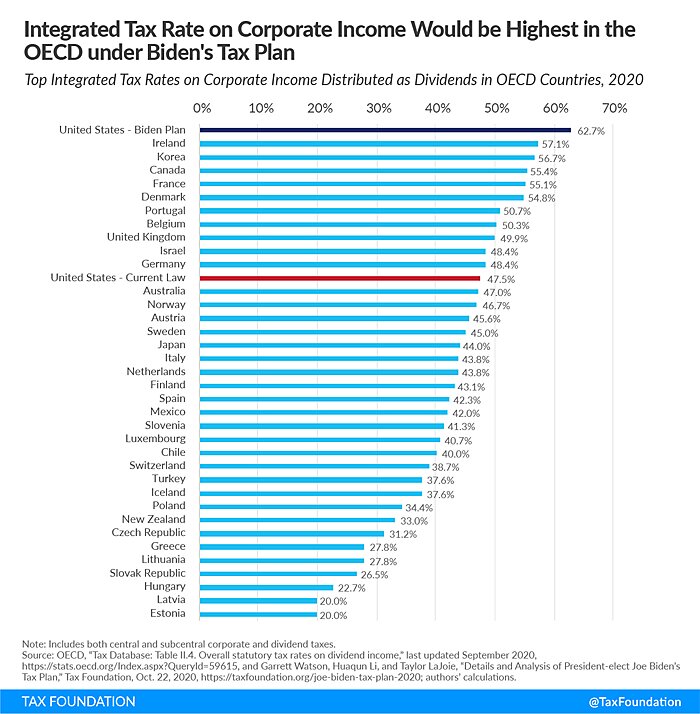

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Individual Income Tax In Malaysia For Expatriates

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Singapore To Impose New Individual Income Tax Rates In 2017 Asean Business News

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Why It Matters In Paying Taxes Doing Business World Bank Group

Malaysia Number Of Petroleum Stations By Brand Statista

Doing Business In The United States Federal Tax Issues Pwc

Company Tax Rates 2022 Atotaxrates Info

Malaysia Payroll And Tax Activpayroll

Corporate Income Tax Cit Rates

Corporation Tax Europe 2021 Statista

Which U S Companies Have The Most Tax Havens Infographic

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

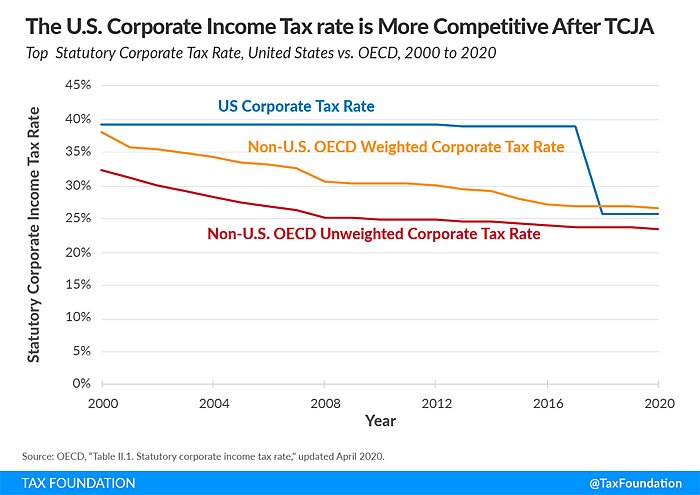

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute